Where is my mobile?

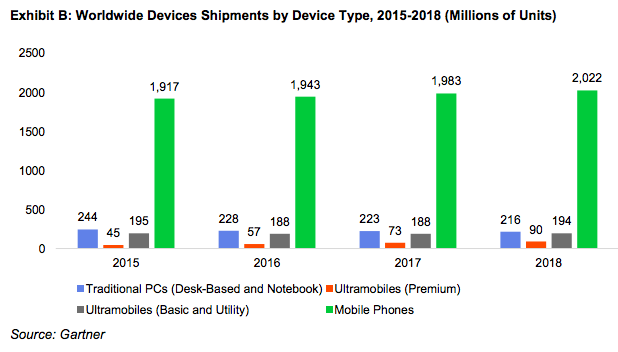

Gartner came out with its latest forecast for computing devices and growth is slowing down to the single digits with the premium segment of PCs (Ultramobiles) being the fastest growing segment almost doubling in the next few years.

However when you look at the real numbers Mobile is now the undefeated king and has grown to a size that it is almost impossible to dethrone it. Even if the entire ultramobile category doubles as expected, it will not be as big as the 105 Mn more new smartphones sold in the next three years!

Mobile is where the big war is going to be for a while. Something fundamentally had changed in 2011 in the tech industry when mobiles outgrew the PC industry:

Another slide from Andreessen Horowitz puts this into perspective in a finer detail. And since most of us dealing with R&D and patents have to be forward looking I took the liberty to annotate their slide with the potential of 3 major future technologies (AR, VR, and Wearables). This slide also explains why Tesla was able to make 10 Bn $ in 36 hours last week (details below).

- Key Insights from Unified Patent’s 2016 Q1 dispute report:

- Lowest NPE activity in 2+ years! Non-NPE activity seems to stay steady across all quarters

- Almost all patent disputes happen in High-tech and medical devices

- 87% of all high-tech lawsuits were still NPE lawsuits, and 92% of all NPE lawsuits were in high-tech

- Over 85% of the NPE lawsuits were by patent assertion entities, only less than 5% were by individuals

- Lowest NPE activity in 2+ years! Non-NPE activity seems to stay steady across all quarters

- Should a computer be eligible for a patent? ~ No this is regarding the Alice issue. But instead, a new paper by Ryan Abbott of Southwestern Law advocates that modern machine intelligence is generating patentable material, and we should extend the ability for corporations to be able to patent ideas produced by “creative computers” to encourage innovation.

- Are you considering reissuing your software patents? ~ In an interesting solution to the threat posed by Alice to portfolios of software companies. Authors of this article mention that a possible solution is handpicking certain patents and having them reissued to strengthen their presumed validity by narrowing their claims. At Dolcera, we believe this is an excellent way to bolster your strongest patents and your entire portfolio in the process

- Tesla made 10 Bn $ in 36 hours ~ Tesla opened order for its new Model 3 (which won’t be launched for years!) and within 36 hours received 253,000 orders with 1,000$ deposits. The average price of the car is 42,000 $ before a tax rebate (which Model 3’s won’t be eligible given that Tesla would have crossed the 200K vehicles shipped mark by the time the first Model 3 is delivered). So basically, people have committed to giving Tesla 10.6 Bn $ whenever they deliver these 253,000 cars. This is great news for players like Panasonic, who supply batteries to EV manufacturers like Tesla.

Now Tesla needs to figure out how it will deliver the orders promptly. It is planning on expanding its Fremont factory. Tesla has shipped some 50,000 cars in 2015, and 107,000 cars in its seven-year lifetimeTesla’s stock is up 27% in the last month! This pegs Tesla’s valuation at 35 Bn $ vs. Hyundai’s 33 Bn $, GM’s 45 Bn $ and Ford’s 50 Bn $. Or maybe they should be compared to a fellow Silicon Valley company only – Uber is worth some 60 Bn $. For context, Toyota is worth 160 Bn $

However, I feel the real winner in the electric car race is going to be a player who figures out the Chinese market. China plans on having 5 Mn EVs on the road by 2020. 5 Mn makes 253,000 looks almost like chump change!

China’s BYD is already the second biggest battery manufacturer after Panasonic. - The bots are coming ~ Kik announced the launch of its bot store beating Facebook to the chase. Besides these messengers, bots are already present in the enterprise messaging app Slack and among one of the most loved feature of the app. Amazon has Microsoft has also been paying attention to the rising trend and automating office intern tasks like calling an Uber to/from a meeting based on your calendar or ordering coffee from Starbucks for everyone in the meeting. The best feature, however, has been the integration with Zendesk to escalate higher priority customer issues faster. They have also launched a bot store for Skype. The more exciting fact is the launch of their bot framework which allows developers to build their own chatbots. However, after the faux pas caused due to Tay developers might be a little cautious. Regardless, the first wave of Human-AI interaction seems to have started, and it’s incredibly exciting.

- Intel builds processors for multiple cloud environment ~ Intel’s announced collaboration with startups CoreOS and Mirantis to help companies ship tasks between multiple cloud computing vendors and their internal data centers.

- Ericson demonstrated LTE-U with Telefonica ~ LTE-U allows operators to use the unlicensed 5Ghz band and improve download speeds in indoor environments. Ericsson showed RBS6402 – a picocell solution which can offer LTE, WCDMA, and WiFi in 10 bands and speeds upto 300 Mbps using LTE carrier aggregation.

- Huawei shows first Super dual-band microwave solution in Egypt ~ These are backhaul technologies which support the infrastructure needed for supporting 3G/4G cells. Huawei tested the technology in Egypt and showed data rates as high as 6.19 Gbps over a distance of 3.37 km. Super Dual Band refers to the use of both traditional (6-42 Mhz band) together with E-Band (71-86 Mhz).

- Meanwhile, Egypt banned Free Basics ~ Facebook’s effort to get free internet to people was thwarted in Egypt too. This time due to Facebook’s denial of sharing customer data. In India Free Basics was disallowed due to net neutrality concerns.

- Ruckus Wireless was acquired by Brocade Communication for 1.2 Bn $. Ruckus had over 400 patents, mostly in 802.11 area

- Snapchat adds Voice & Video calling to compete with rising competition

- Tinder acquires Humin to expand into contact management and setup an SF office

- On-demand app PostMates launches prime-style subscription. This is a growing trend in the on-demand food delivery with Munchery and Sprig having their own versions. Given that Amazon is also kind of like “on-demand” shopping it makes sense that on-demand startups are moving to a subscription model. Makes me wonder if Uber/Lyft will ever release a “subscription model” where you can pay 300-400$ for 20-30 commutes in a month!

- Citigroup shows the potential of VR with Hololens trading app

- Mars Petcare acquires Whistle (the Fitbit of dogs!) – This news came out on 31st March, so I double checked from multiple sources. It’s a real thing!

- AT&T wants to launch Cyanogen based devices in the US as it no longer considers Google an ally.

- SunEdison is preparing for bankruptcy

- Persado raised 30 Mn $ for AI based copywriting

- Groupon raised 250 Mn $ in post-IPO equity

- Hungama raised 25 Mn $ to bring video/music streaming to India. Xiaomi was the lead investor

- Slack raised 200 Mn $ for engaging enterprise messaging

- Managed by Q raised 25 Mn $ to help manage offices in an on-demand manner

- Juicero raised 70 Mn $ to sell cold-pressed juice. Yep, Silicon Valley is getting into food big!

- Garena, the maker of TalkTalk, raised 170 Mn $

- Cockroach Labs raised 20 Mn $ to help company setup resilient and scalable infrastructure

- Asana raised 50 Mn $ to compete with the growing enterprise collaboration startups

- Invoca raised 30 Mn $ to help inbound sales teams

- Spotify raised a billion $ in debt!