Cloud will make it rain?

At least, the major tech companies are hoping so. As discussed last week, the Unicorns are increasingly reliant on the Cloud and flexible infrastructure availability to be able to scale up and down. Even major tech players like Apple are finding it easier to outsource cloud computing even after having invested years in trying to develop internal infrastructure and running into both software and hardware issues needed for the scale at which they operate. The direct impact has been on the traditional vendors like HP, Cisco, NetApp whose hardware/software being sidestepped for custom infrastructure built for providing reliability and security at the Exabyte/petabyte levels. No wonder that they are looking for investment opportunity in the new technology landscape. e.g. HP recently led a big 73.5 Mn Series C round in Mesosphere (makers of Data Center OS – Microsoft also participated in the round).

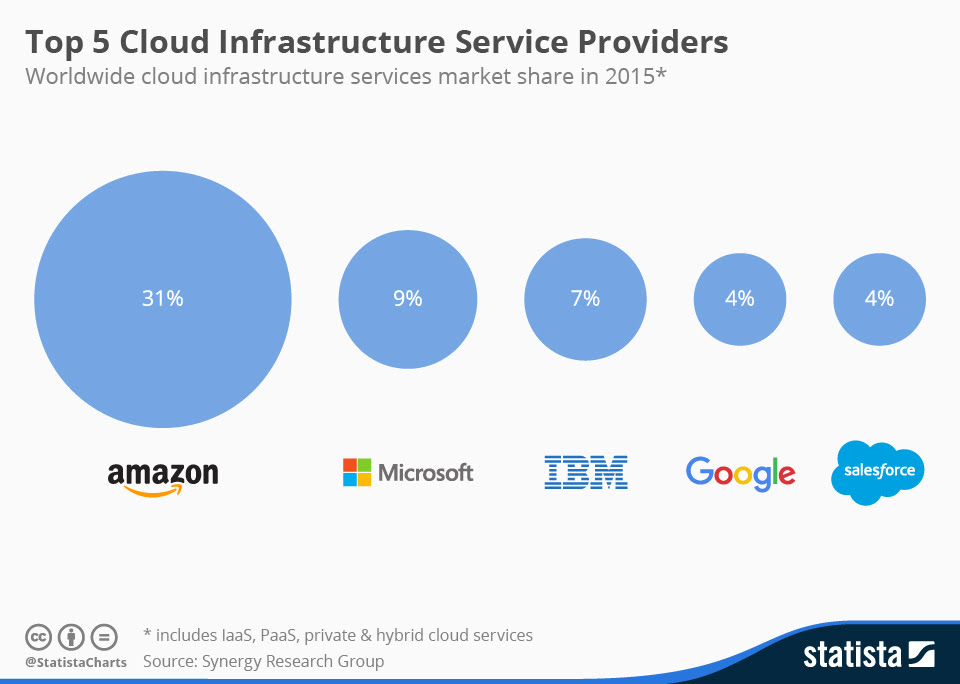

The overall market is somewhat oligopolistic with the top 3 players controlling almost half of the market.

There is also no dearth of smaller players like Digital Ocean and Rackspace. In fact, the market is significant and fast growing enough that new players are entering every week. Last week GoDaddy announced the launch of its Public Cloud to take on Amazon, Microsoft and Google Cloud. Given Godaddy’s unique position as a leading destination to buy URLs for small businesses it might be able to make a dent in the market. Gartner estimates the IaaS market to be around 20 Bn $ every year and growing at 35% clip.

- Apple-Samsung goes to Supreme Court ~ Samsung contends that the 1887 statute around design damages is out of sync for our modern devices where design is just one of the features enabling the sophisticated device. However, as a result, Judge Koh has put a hold on the retrial citing judicial economy.

- PTAB criticized for black box process by Federal Circuit ~ PTAB drew fire from the Federal Circuit Judge Jimmie Reyna, who said that it can not set up a black box decision-making process. He, however, concurred with the decision that PTAB’s decisions are unreviewable under Cuozzo.

- Uniloc’s ‚216 DRM patent declared invalid at PTAB

- 30 VR games are coming to Oculus today ~ With forecasts of VR/AR being a 150 Bn $ opportunity by 2020 things are heating up on the content side too. However, I feel that the unlikely winner in all this is going to be Microsoft given that 3 of the 4 VR platforms (Oculus, Vive and Hololens) are Windows PC based. Here is what the gaming platform landscape looks like right now:

- Snapchat is starting to make inroads in the advertising world ~ More and more major brands are getting on Snapchat with consumer electronics and CPG companies being laggards. Snapchat is also starting to do its own 100 Mn $ acquisitions. It recently acquired the market of personal emojis Bitmoji’s parent company Bitstrips.

- YouTube said to be working on a Periscope competitor ~ Live streaming, and vertical videos appear to be the thing ever since Snapchat & Periscope have proved themselves viable. YouTube, which was already starting to feel the heat by Facebook’s video efforts (Facebook algorithm prefers Facebook’s native videos. They also launched a live streaming feature recently) to stay relevant is said to be working on its live streaming app. However, in the absence of a solid social layer, these efforts might just be in vain.

- Apple gets into the exclusive video content business

- Adobe wants to move from content creation to full marketing cycle.

- Wearables market is growing at more than 50% YoY – The wearables market hit 2 Bn $ last year and is expected to keep growing at over 50% year on year for the next few years. A whopping 71% of the 16-24-year-olds want to buy some sort of wearable tech.

- Pebble slashes 25% of workforce ~ The growing wearables marketplace, however, doesn’t always translate into success for all players in the market. Pebble is cutting 25% of its 160 person team citing conservative funding environment in the VC community. Somehow with all the talk of tech bubbles, „a conservative VC environment“ doesn’t sound too bad to me.

- Sports companies are eating Tech players ~ Sports gear manufacturers are starting to feel the heat of the wearables and quantified-self movements. Here is a quick snapshot of the investments and acquisitions made by major sports gear manufacturers

- Huawei pushes for mobile payment in China ~ Currently Alibaba (70%) and TenCent (19%) dominate China’s mobile payment market. However with a rapidly expanding market (China’s mobile payments grew 64% last year to 373.2 Mn $) handset manufacturers like Huawei, Samsung and Apple are pushing hard for a piece of the pie. Huawei hopes that it’s 15.2% market share in the low margin market could yield value in other ways.

- Square partners with Facebook to buy ads ~ Square is another example of a hardware player in a commodity space trying to monetize its user base. It has now partnered with Facebook to allow small business to buy advertising. Square sees its fastest growing segment of services to its user base. It already offers marketing options like newsletters and other marketing. The recent partnership with Facebook would allow it to enter the social space as well.

- Google can’t get enough of the iOS ecosystem ~ Google is building an iOS keyboard which is exciting news because iOS keyboards are still stuck in 2007! But it’s an interesting play by Google to penetrate deeper into the competing ecosystem with apps. It currently has 64 apps on iOS.

- Dyson bets 1.44 Bn $ to compete with Tesla ~ Dyson is reportedly working on an electric car as well. Dyson has over 1250 patents related to electric motors and with its announcement to spend 1 Bn $ in battery development it is making UK relevant again to the Lithium Ion technology. Here is a slide from Dolcera’s recent webinar covering advanced in Lithium Ion technology in detail.

Battery Technologies Webinar.pdf Will you buy a car from a Vacuum car manufacturer? I can’t take my eyes of the new Prius Prime! PHEVs FTW!!

- GM wants you to hack them ~ GM is learning from bounty programs usually used by tech firms to find vulnerabilities before the dangerous hackers too. Uber is running similar programs too.

- Juno to start price wars on supply side in ridesharing ~ A new stealth ridesharing app in New York Juno, founded by Talmon Marco (of Viber fame) wants to reduce the 20% standard charge set by Uber & Lyft to 10%

- Uber sues Indian competitor for false bookings. What’s the word I am looking for? – Deja Vu 🙂

- Convoy raised 16 Mn $ for on-demand trucking

- Microsoft wants a piece of Yahoo when it goes up for sale

- First Chinese-owned plant dedicated to memory chip manufacturing opens

- Streaming revenue crosses 2 Bn $ to become the leading source of revenue in Music Industry

- Hedge funds begin pulling out of Silicon Valley as returns disappoint

- Grocery delivery company Instacart claims profitability. Meal-delivery company Doordash went for a down round with a 16% cut in valuation to raise 127 Mn$. UAE-based Abraaj group is leading a 150 mn $ round of investment in India’s BigBasket.com to compete with Amazon.

- ABI Research forecasts biometrics to be a 30 Bn $ market in 2020

- Google wants to build an Amazon Echo clone. Meanwhile, it launches it’s speech recognition API for developers.

- Stratoscale raised 27 Mn $ to develop data center solutions. Bromium raised 40 Mn $ to develop micro-virtualization technology focused on security for enterprise

- June raised 22.5 Mn $ to build a Smart Oven

- Soasta raised 30 Mn $ for performance analytics. Betterworks raised 20 Mn $ to help companies better manage their projects

- Zeel raised 10 Mn $ for on-demand massage. The second startup in the area this month after Soothe

- Lagou.com raised 34 Mn $ for staffing support in Asia. Checkr raised 40 Mn $ for automating background checks. TaskUs raised 14 Mn $ in debt to help companies better manage their virtual office operations.

- ScienceExchange raises 25 Mn $ to allow people to order experiments from the best labs remotely

- TravelZen raises 93 Mn $ to integrate online travel products